|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

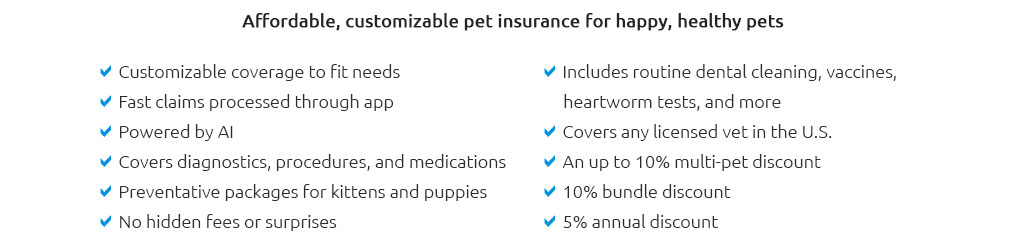

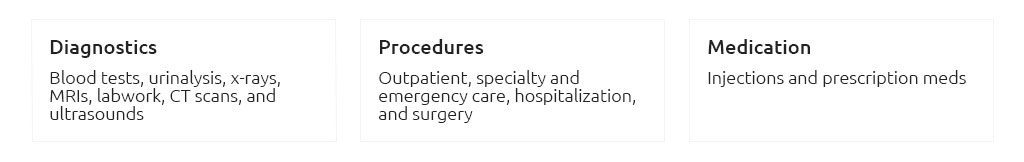

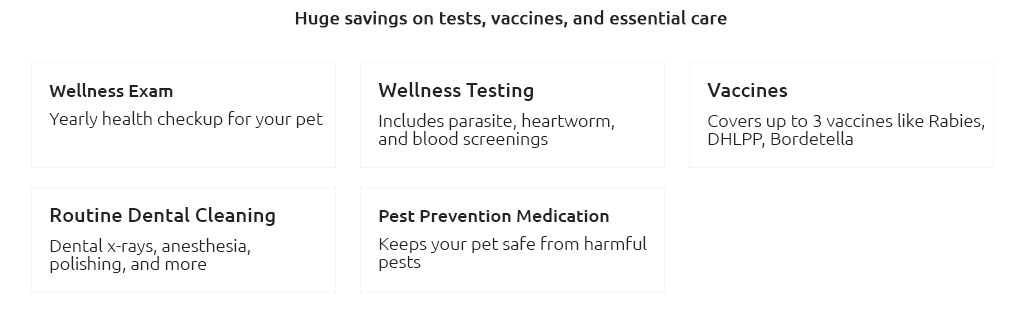

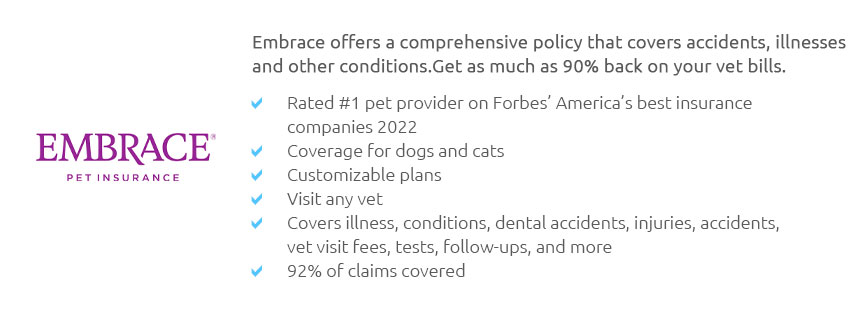

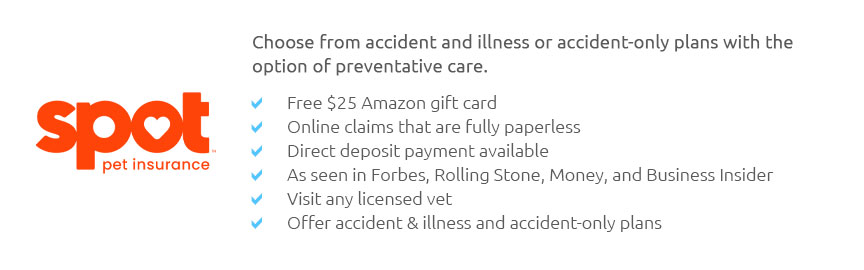

Best Pet Insurance for Huskies: A Comprehensive GuideChoosing the right pet insurance for your husky can be a daunting task. Huskies are energetic, adventurous, and sometimes mischievous, making it crucial to have an insurance plan that covers their specific needs. In this guide, we will explore various options to help you make an informed decision. Why Huskies Need Specialized InsuranceHuskies are known for their high energy levels and unique health requirements. They are prone to specific conditions like hip dysplasia, cataracts, and hypothyroidism. Therefore, it is essential to choose a pet insurance policy that caters to these potential health issues. Top Features to Look ForComprehensive CoverageEnsure that the insurance policy covers a wide range of health issues, including chronic conditions and hereditary diseases common in huskies. Flexible PlansLook for plans that offer flexibility in premiums and deductibles, allowing you to choose a plan that fits your budget. Additional BenefitsSome plans offer additional services like wellness coverage and even grooming, which can be beneficial for maintaining your husky's coat and overall health. Consider exploring pet insurance with grooming options for added convenience. Top Pet Insurance Providers for Huskies

For a detailed comparison of these providers, you may visit pet insurance which is best for a comprehensive review. Understanding Policy ExclusionsIt is crucial to thoroughly read and understand the exclusions in any policy. Common exclusions can include pre-existing conditions, cosmetic procedures, and certain breed-specific health issues. FAQs

https://www.reddit.com/r/husky/comments/18dsdp2/do_you_guys_use_pet_insurance_for_your_husky/

859 votes, 68 comments. 201K subscribers in the husky community. This subreddit is dedicated to Siberian huskies, anything related to the ... https://www.pawlicy.com/dog-insurance/siberian-husky-pet-insurance/

With Pawlicy Advisor, you get a personalized Coverage Score and Lifetime Value Score for hundreds of policy variations for your Siberian Husky from top pet ... https://www.embracepetinsurance.com/breed/siberian-husky-pet-insurance

Embrace's strongest points of comparison include our flexibility and comprehensive coverage. Other companies have full or partial limitations on genetic and ...

|